US import costs can be quite confusing, especially for first time importers. Read on for an overview of the US importing market, understand shipping and customs-related processes and learn about common import costs.

Understanding US import costs and processes

US import costs by the numbers

The United States is considered the second richest country and largest importer in the world. Last year, it bought US$2.309 trillion worth of imported products. This is 4.7% higher compared to its imported goods last 2011.

What are the common costs when shipping into the US?

- Product

- Mode of international freight

- Arrival agent fees

- Independent inspection

- Warehouse fees

- Drayage and trucking fees

- Cargo insurance

What are the customs-related costs when importing into the US?

- US Customs duties and fees

- US Customs bond

- Importer Security Filing (ISF)

- US Customs exams

- Fumigation certificate

US goods in flows by partner for 2022

US import costs by the numbers

The US is the second-richest country and largest goods importer in the world. In 2022, the US bought $3.2 trillion worth of imported goods. This is up 15 percent ($414 billion) from 2021. In 2016, the US imported $2.3 trillion of goods. This was an increase of 43 percent in five years. Clearly the market has become very large and is growing at a steady rate.

China was the largest supplier of imported goods, accounting for 17 percent. In 2022 the top five suppliers of imported goods to the US were China ($536 billion), Mexico ($455 billion), Canada ($437 billion), Japan ($148 billion) and Germany ($147 billion). It is interesting to note that the EU supplied $553 billion. For more data on US goods imports from the world.

To get involved and participate in this expanding sector, it is of the utmost importance to know a number of key factors.

How to import goods into the US?

Entry of goods and compliance to Customs rules and regulations are some of the things you should consider when importing goods into the US. You can do it on your own, however it involves many complexities. If you need to learn how to import goods into the US, read our guide for first time importers?

It is easier to let freight forwarders and customs brokers handle it for you. Here at FFQO, we provide reliable and cost-efficient Customs brokerage services. Talk to us to learn how we can help speed up the import process for you.

What are the common import costs when shipping into the US?

You’ll need to pay various taxes, duties and fees when importing goods into the US which includes:

- Customs duties and fees

- Customs bond

- Importer Security Filing (ISF)

- US Customs exams

- Fumigation certificate

But wait – there’s more to these! Learn what other factors you need to consider when importing into the US:

- Product and mode of international freight

- Arrival agent and inspection fees

- Warehouse fees

- Drayage and trucking fees

- Cargo insurance

Summary of estimated import costs to US

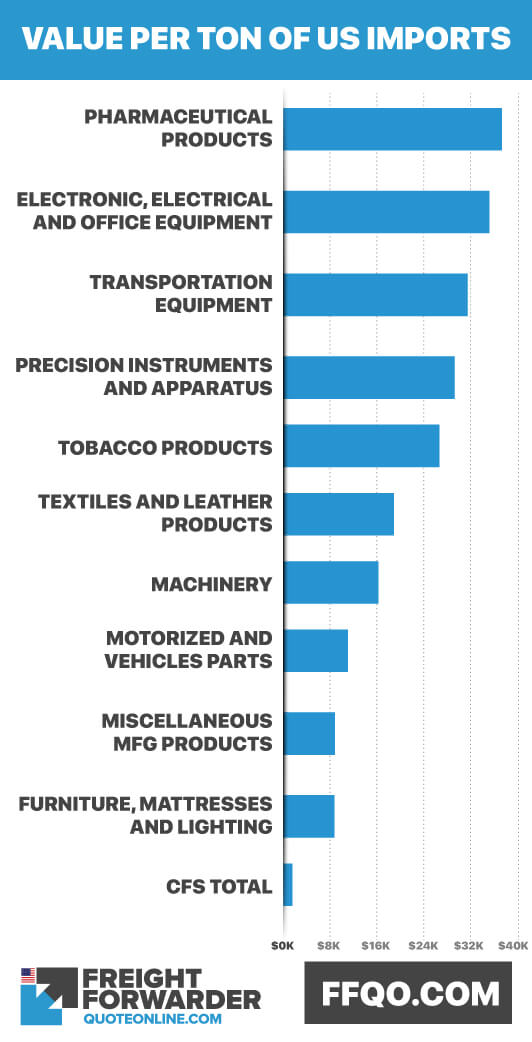

Product

The type, weight and amount of product you wish to import influence your total import costs. Many costs for importing into the US depend on the total value and type of goods you are importing. An example is the import duty. It can be useful to know the costs of different types of imported goods expressed as ratio of value per ton, and it can help you estimate overall costs for a given shipment. To learn more about the tariff rates of specific products.

US imported commodities ranked by value per ton

Mode of international freight

There are two ways by which your cargo can be imported from a foreign , i.e. by air or by sea. There are significant differences between them in respect to cost and transit times. Learn more about these differences between air freight and sea freight. To get an instant shipping quote for air or sea freight, use our online shipping calculator.

To ship or fly? What is its implication to your import costs?

Arrival agent fees

It is the arrival agent’s duty to monitor your cargo once it arrives safely at the airport of destination. Moreover, he/she must ensure that it will keep moving until it reaches its final destination. This is achieved through arranging how your cargo will arrive at your or your customer’s doorstep.

Shipping arrangements usually include the arrival agent’s fee. If not, you will need to pay the agent for managing the landside logistics. On average, the arrival agent fee ranges from $300 to $500.

Leave your worries behind because we handle all of these matters for you. Just tell us how, where and when you want your freight delivered.

Independent inspection

There are times when you may want a quality independent inspection company to check the condition of your goods. You are welcome to demand this, however this does attract additional financial outlay. Costs range from $300 to $400 a day per inspector, depending on the imported goods’ origin.

What are the import costs for independent inspections of your cargo?

Warehouse fees

One particular necessity for your cargo is the warehouse, which is where your cargo is held temporarily. The warehouse fee depends on the quantity and volume of your cargo, and ranges from $0.25 to $0.45 per cubic foot. If your goods are not picked up on time, you will have to pay additional fees, such as demurrage. This cost ranges from $30 to $500 per day for typical shipments.

Learn more about warehouse and cargo storage import costs

Drayage and trucking fees

Drayage and trucking services are important for importers, particularly if you don’t have your own trucks to collect goods from the warehouse. You will need to book and pay for these services.

The chargeable weight and the base fee are the two parts of the cost. The base fee is usually a set fee for a threshold weight. This is typically an amount such as 100 pounds of cargo. When the weight exceeds this threshold – 100 pounds in this case – a rate is then applied for every pound increment. It is important to get an accurate estimate of drayage fees as they vary significantly and could end up being double what you expected and calculated. Talk to us if you have questions.

Sample drayage fee calculation

Cargo insurance

Accidents are bound to happen whenever and wherever. As a result, cargo insurance is there to protect your goods from financial loss. It is, therefore, vital you include it in your budget.

After all, it doesn’t hurt to spend a penny for a dollar to be saved. Right?

The minimum estimated cost for this is $80 or 3% of the total value for the imported goods.

Customs-related import costs

Customs fees contribute significantly to your import costs into the US. There are a number of components to check for.

US Customs duties and fees

You need to pay customs duties and fees once your goods enter a specific country. For US Customs, the regulations for the duties depends on the Harmonized Tariff Schedule . Duties are applied by percentage and vary depending on the type of your cargo and the volume of it.

There are two additional mandatory fees applied to your shipments:

- Merchandise Processing Fees (MPF): 0.3464% of your shipment total value. Furthermore, it must range from $25 to $485 only.

- Harbor Maintenance Fees (HMF): 0.125% of your shipment through identified ports. Nevertheless, HMF is not collected on cargo imported through air.

US Customs bond

The US Customs Border and Protection (USCBP) requires some version of a Customs bond for all imports. It acts as an insurance policy that guarantees payment in case any mishaps happen through the course of the transaction.

Continuous Transaction Bond

This is a one-year term obtained by importers who have numerous entries through ports during a given year. It is valid until terminated by the principal (either importer or broker). It is, therefore, highly recommended for large and regular transactions.

The minimum bond amount for continuous bonds is generally $50,000.

Single Entry Bond

Importers obtain a single entry bond for a single shipment. It covers only the entry or transaction for which it was written. Hence, this is most suited for single transactions only.

The minimum amount for a single transaction bond is $100.

Exemption to custom bond payments

If your imported goods are valued at over $2,500 you will need to pay a Customs bond. On the other hand, if your goods are below $2,500 in value you can file an informal entry for your goods to be exempt from Customs bond payments. Refer to monetary guidelines for setting bond amounts for further details.

Importer Security Filing (ISF)

The Importer Security Filing (ISF) – commonly called “10+2” – is a requirement for goods arriving in the US via ocean vessels. This is, however, not a requirement for bulk cargo.

Unlike Customs bond, US Customs Border and Protection will only require you to release money if you are not able to comply with the rules they have. It therefore acts as a penalty, and can range from $5,000 to $10,000.

Learn more about Importer Security Filing (ISF)

US Customs exams

All cargo shipments need to pass through a Customs examination. It is at their discretion to decide at what level they will examine your cargo.

Non-Intrusive Inspection (NII) or VACIS

This type of examination makes use of gamma ray technology to produce images from containers to check for drugs, currency or weapons.

This costs around $150 – $350 per container, depending on the size.

Tailgate or backdoor

On this examination, Customs staff move your cargo to an exam area. They will then open the back of the container for checking without disarranging your cargo.

This costs from $100 or more, depending upon the port where the cargo is held.

Intensive

This is the examination you surely hate the most. It is when your cargo undergoes a thorough search. This only happens, however, when a suspicious item is spotted during the VACIS exam. This is rare, so don’t worry too much.

This costs approximately $1,000 to $2,500 or more. This depends also on the required labor, container size and port where the cargo is held temporarily.

Fumigation certificate

The US Department of Agriculture Animal and Plant Health Inspection Service (APHIS) requires fumigation of wood packaging materials (WPM) such as wooden pallets, crates and wool. This is in compliance with CFR 319.40.

Costs range from $38 to $270 and depend on the cargo volume.

How does FFQO make all of these import costs and processes simple yet cheaper?

You can do the calculations and the negotiations yourself. However, this is too much to handle. FFQO has established relationships with shippers, warehouse owners, truckers and Customs brokers to make the tasks of moving your goods into the US fast and easy.

Talk to us to know how simple we can make it for you. Use our online freight calculator to receive a free quote, today. Know the approximate import costs for your goods quickly and easily.

Need help on the US import costs and processes?

We offer a full range of freight forwarding services and are confident we can give you the help you need if you have questions of US import costs and processes. Freight Forwarder Quote Online is able to give you the best prices as we have low overheads.

If you are looking for air freight forwarding that is fast, lean and transparent, then contact us online and send a message. You can even message us on Facebook for help on international shipping.

Got any questions? Talk to us for any of your concerns regarding the US import costs and processes. We are happy to answer them for you.