The cargo ship traffic jam that resulted from the Evergreen freighter temporarily blocking the Suez Canal was a serious shipping problem. However, it was far from being the biggest shipping problem of the year. Since late 2020, a massive cargo ship traffic jam at the southern ports of California is affecting US manufacturers and agriculture and costing billions.

- Multitudes of freighters are held up for a week or more until they can unlade

- Businesses are held up for long periods, waiting on products or components

- Agronomic producers have been and are facing major difficulties in exporting their goods overseas

US economy is losing billions due to gigantic long-lasting cargo ship logjam at California seaports

The largest known cargo ship traffic jam ever

Generally no freighters are lying, still fully-loaded, off the LA, Oakland and Long Beach seaports. A vessel may sometimes have to be held over for 24 hours or so, but in April there were 23 sitting offshore of CA’s seaports in the state’s south. And this is a great improvement on the numbers – approximately 40 – in February!

A lot of the holdup is due to the global Covid epidemic. Online shopping has grown hugely during the periods of enforced isolation, thus stimulating purchasing across the board within the US. The extra shipments traditionally in the holiday periods just add to the problem, but there are other matters exacerbating the situation and making resolution extremely difficult.

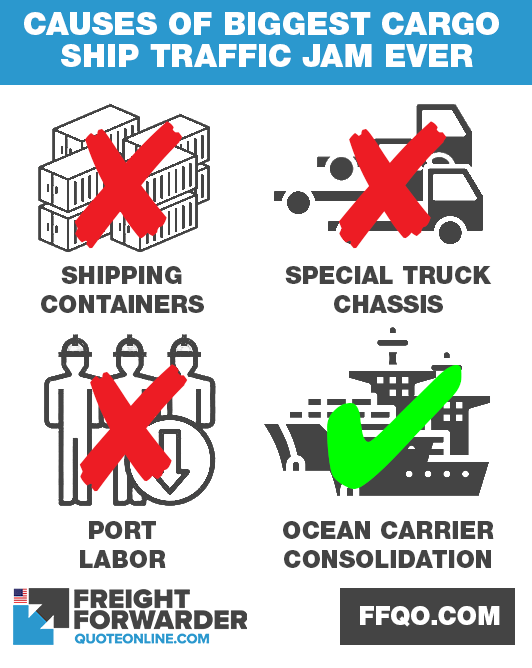

Scarcity of shipping containers

To start with, ocean carriers lack sufficient shipping containers where they’re needed in order for freight to move satisfactorily. This is exacerbated by some freight companies unlading stateside then shipping the containers, unused, back to the East. The reason for this is that right now it’s to carriers’ economic advantage to utilize shipping containers for this, instead of sending agronomic goods elsewhere, e.g. Europe. The reduced accessibility to shipping containers really impedes the speed cargo can be onboarded for freighting overseas.

Scarcity of special truck chassis

The vehicles that carry shipping containers to seaport storage areas need special chassis. The California southern ports lack sufficient of these to keep abreast of the increased need. Further, there is insufficient area for holding empty shipping containers or containers to be filled at these seaports. When the available area is filled, cargo ships must stand idle, waiting to be loaded or unloaded.

Port worker shortage

Throughout the pandemic, longshoremen, along with many others across the US, have faced Covid infection or risks. And at the same time they’ve taken care of their families and their homes, so there’s been a far greater than normal increase in work non-attendance.

Ocean carrier consolidation increase

International cargo freight is primarily combined. Around 20 years ago, there were more than 24 ocean carriers. Today there are only nine. Importers and exporters don’t therefore have the freight choices previously available. Further, the connections between carriers, seaports and machinery owners are neither clearly delineated nor easy to work with.

What is causing the biggest cargo ship traffic jam ever in history

How the cargo ship traffic jam effects on US economy

The ongoing bottleneck and associated operational hurdles have obstructed US producers in their efforts to sustain stateside manufacture and US growers in satisfying growth in the overseas market.

High savings rates and stimulus have boomed imports

The level of goods and commodities coming into the US fell sharply early on in the global Covid epidemic, but started to recover mid-2020 and have continued to rise. When Covid-related constraints lifted, buyers began 2021 enthusiastically, keen to buy products and engage with commercial businesses.

Powered by almost unprecedented levels of private funds reserves and government assistance, the level of merchandise/products is outperforming that of normal Q1 and Q2. For Q1 2021, aggregated US importations have increased $138 billion over Q1 2020 levels.

Agricultural product foreign demand has made exports soar

California’s Los Angeles, Oakland and Long Beach seaports are also major transoceanic commerce hubs. Relative to overseas trade, these centers have been humming. In Q1 2021, container shipments were 36% higher than previous years. It is notable that LA, Oakland and Long Beach are the first, second and third sea ports, size-wise, for US agronomic exports by container.

Problem of shipping empty containers to China rather than export

In Q1 2021, the number of empty containers in CA’s three premier seaports jumped from the Q1 2018-2020 average of 1.16 million TEUs (20-foot equivalent units) to 1.81 million TEUs, an increase of 56%. Compared to Q1 2020 alone, 2021’s first three months show an 80% hike in unfilled export shipping containers. Ease of access to export containers has been further eroded by the exceptionally high shipping costs and damaging surcharges. Taking all this into account, it has been extremely difficult for homesteaders and graziers to meet their transoceanic contractual obligations. Indeed, in the agribusiness sector, it has been estimated that some $1.5b has been lost.

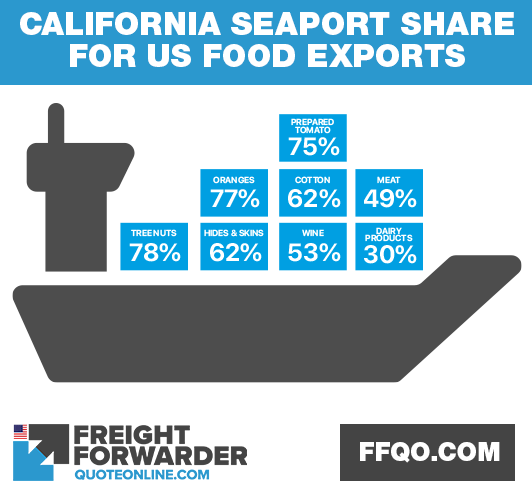

The three southern CA seaports are vital for the US’ transoceanic agribusiness, they are absolutely crucial for the export of some agrarian commodities. As shown hereunder, CA seaports carry more than half the US’ many agrarian products shipped internationally. As an illustration, around three-quarters of all US tree nuts, citrus and processed tomatoes are shipped from the LA, Oakland and Long Beach area. And from the same three seaports, combined, are sent more than 60% of the US’ transoceanic shipments of cotton, hides and skins; around 50% of US meat and wine, and 30% of US dairy products. In the years from 2016 and 2020, US exports of these products from these CA seaports were almost $22b.

The growth in overseas demand for US agronomic commodities amplifies the critical lack of shipping container accessibility and operational workarounds to the holdups at western seaports. This is exacerbated by the seasonality of some farming/agrarian goods, making it imperative a solution is found to the problem of seaport holdups. Oranges and cotton are a case in point. They are traditionally shipped at premium rates between May and January. Edible nuts have their peak season between October and December. These export shipments are gravely affected by the seaport logjams that commenced in October 2020. The difficulties for exporters to honour their international trade obligations impact not only their future income prospects, but also affect their relationships with overseas trading partners.

California seaport share for US food exports

Need help reducing impacts of this cargo ship traffic jam?

Right now, when prices are high and stocks are low, the efficient and timely meeting of consumer demand is essential to see us through the Covid-caused supply chain havoc. We can supply holistic guidance on freighting cargo by sea. Through us, you can move your goods in a timely manner. Partnering with us, you are working with specialists who are renowned worldwide for their ability to get your cargo to where it needs to be, when it needs to be there. Feel free to contact us online or message via our Facebook page. We are happy to assist.