When it comes to international shipping there is pretty much a rule for everything, including freight payment methods. It can be confusing to work out which is the best freight payment method to use. Find out what this rule of thumb is for importers and exporters when paying for freight.

What is the best freight payment method to use for import and export?

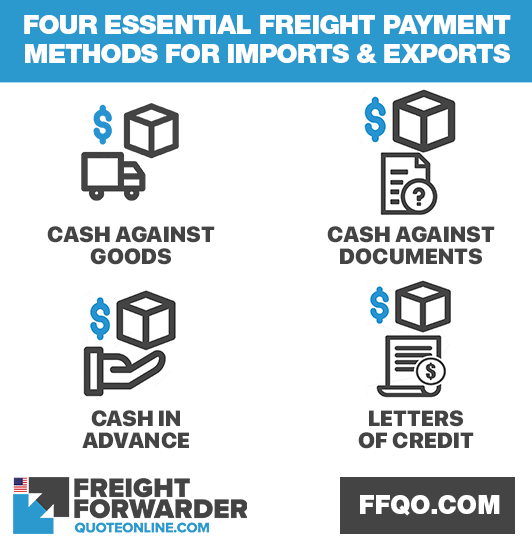

Four essential import and export freight payment methods

A vital decision is deciding how you’ll pay for your shipment. There are several options and it’s important to choose the right freight payment methods to fit both your and your customers’ needs.

You can even break it down further. Some freight payment methods are designed for importing and some for exporting. This article will walk you through your options and guide you towards the best one to choose.

Below are the four essential freight payment methods used by the majority of importers and exporters.

Cash against goods

Like most shipments this type of payment is governed by a bill of exchange. A bill of exchange is a non-interest-bearing written order used primarily in international trade. It binds one party to pay to another party a fixed sum of money at a predetermined future date.

In simple terms it’s a check that describes a transaction and what’s to be paid.

In a cash against goods (CAG) import, the exporter relinquishes all control over the goods when they’re shipped. In order to protect the exporter, the importer’s bank will guarantee the shipment by agreeing to pay for the goods outlined by the bill of exchange. Essentially, the importer’s bank becomes liable to the exporter upon receipt of the goods.

Cash against documents

Like the previous method this one hinges on the bill of exchange. This is a very common importing payment method and is in many ways virtually identical to the CAG.

In this freight payment method the exporter gives the importer bank control. The bank is allowed to release the shipment and associated documents only upon them receiving payment from the importer. So, basically, you ship a load of widgets to a company overseas. That company pays their bank and their bank pays you. Only then can they take possession of their containers.

Cash in advance

As you might expect, this is probably the simplest form of transaction. Basically, the importer pre-pays for their shipment – it’s as simple as that. Of course this type of payment arrangement is very much based on your relationship with the person on the other side of the international border.

Letters of credit

Letters of credit are very common. They work like a credit card. For example, someone overseas orders three container loads of widgets from you. This importer gets a letter of credit from their bank, then sends it to your bank. You then ship the goods. When the importer receives them your bank pays you.

Of course, letters of credit aren’t quite that simple. They must contain certain items and documents, such as:

- Product numbers

- Shipping terms

- All transaction information

- Quality control methods

They depend upon the bill of lading.

For more in-depth information on how letters of credit work, read our dedicated blog on letters of credit in freight forwarding.

Types of letters of credits as freight payment methods

Like most things involving the import and export of goods, letters of credit aren’t a single instrument. There are, in fact, many different kinds. Let’s briefly review and define them for you.

Revocable

The buyer or the bank that issued the letter of credit can make changes without informing the seller. Of course, most – but not all – letters of credit are irrevocable now, making this form obsolete.

Irrevocable

Any changes made must be approved by the beneficiary – the seller.

Confirmed

When a second bank also agrees to back the L/C.

Unconfirmed

This type doesn’t require the second bank’s approval.

Deferred

As you might expect, this form of letter of credit allows the buyer to defer payment for a time. Sort of a letter of credit on credit, if you will.

Sight

When the issuing bank immediately pays the seller, upon inspection of their carrier documents.

Mixed Payment

This is a form of letter of credit where the seller and buyer agree to more than one form of payment.

Acceptance

Payment is made upon the buyer’s acceptance of the goods being shipped.

Standby

In essence, this is a backup payment method.

Revolving

This is an open letter of credit that can be used across more than one shipping transaction.

Red Clause

Before shipping the product, the seller is allowed to take the pre-paid part of the total payment.

Transferable

This letter of credit can be assigned to a third party without endangering the transaction.

Back-to-Back

This is a pair of letters of credit that allows a seller who, for a specified reason, cannot provide the goods, to get paid. For example, a middle-man company that handles the actual shipment.

Four essential freight payment methods for importers and exporters

Advice from Adam on freight payment methods

For sellers or buyers with whom I have never done business, Adam says he would always purchase or sell under letters of credits. This is for reasons given above and that the letter of credit provides protection for all the parties involved. Once a good trading history has been established, he then recommends negotiating whichever freight payment method suits both the seller and buyer.

Add Adam to your LinkedIn connections to directly ask him your questions, today. Or contact and send him a message online.